LMM Buyout- ENT Industry Review

- nipunkapur5678

- Sep 13, 2023

- 5 min read

Updated: Oct 26, 2024

With the rise in dry-powder that private equity firms possess, the private equity firms are looking to invest in all the niche fields that were a bit off limits earlier. One of such fields is the ENT (Ear, Nose and Throat) and allergy field. At least over the past few decades, private equity has been a driving force behind the general trend in many industries towards consolidation into larger operating units. Healthcare is not an exception to the general perception that you need to grow to survive in many businesses. With about ten major platforms already operational, ENT and allergy is a relatively young area for private equity investment. In comparison to ophthalmology and dermatology, the total number of transactions to date is quite low, and there is still plenty of space for growth. Ophthalmology, dermatology, and dentistry were among of the first healthcare specialties that PE firms sought to invest in. Each of the specializations is generally hospital independent, has a high number of small and independent practices, and experiences supply and demand tailwinds. Oncology and orthopedics quickly followed in that order.

One of the biggest problems in a lot of physician practices that the doctors find themselves dealing with almost on a daily basis is that instead of catering to their actual field, most doctors find themselves catering to their ‘business’. Although the major goal of the practice is to in fact, make money, it is vital to understand that business is not the physicians’ field of choice or profession. Dealing with compliances, marketing, insurance etc. end up becoming the major time consumers. Dealing with administrative responsibilities is, in fact, frequently listed as one of the main causes of physician burnout and job unhappiness. In addition, an ageing population, rising chronic disease risk and diagnosis, and enhanced treatment options all favor several healthcare specialties. The need to see more patients more effectively is fundamental. This can be done through introduction of better and more effective technologies which also, in turn, require the professional’s attention.

Private equity professionals build economies of scale that can raise purchasing power and reduce operating expenses by acquiring and integrating practices. PE can offer the personnel and financial resources required for expansion, buying new equipment, and creating supplementary business lines additionally.

Over the last decade, from 34 deals closed in 2010 to a record 121 transactions completed in 2019, investments by PE firms in the ENT space have increased at a compound annual rate of 12%.

Even if financial sponsors scaled down a little in 2020 due to the entrance of COVID-19, the fewer but larger deals completed in ENT/allergy nevertheless resulted in an increase in disclosed value year-over-year (YoY). While the pandemic led some to cut back their M&A plans in the early going, activity in this sector soared in the second half of the year, rising from a low of 19 agreements completed in Q2 to 34 in Q3, and an astounding 54 transactions to close out 2020. As of March 2020, there were 16 completed mergers and acquisitions, including those involving larger healthcare systems and hospitals, thanks in part to the increasing excitement of PE companies for physician-led practices in the sector. In January 2020, South Florida ENT Associates (SFENTA), the largest ENT/allergy group in Florida, announced a partnership with Texas ENT Specialists (TENTS) to create a new organization with 60 ENT clinics. Audax Private Equity, a prominent financial sponsor in several specialized healthcare service industries with offices in Boston, supported the transaction.

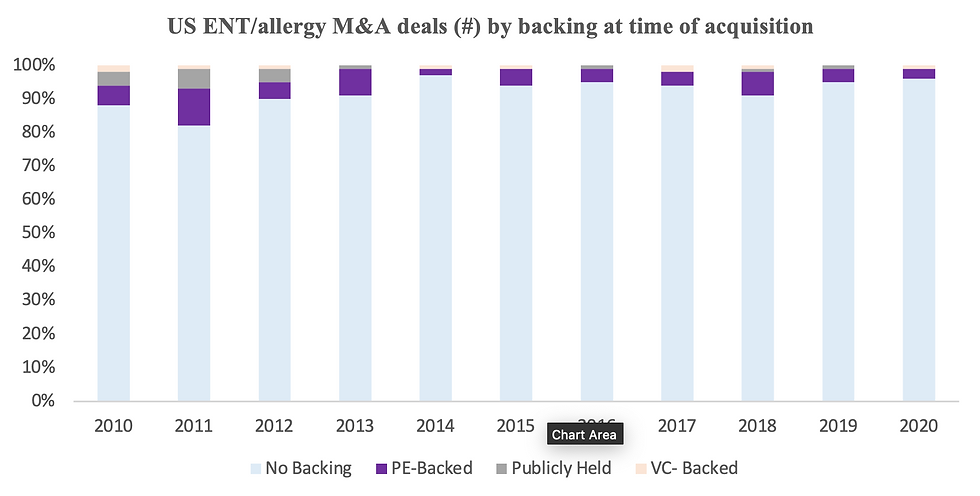

By the end of February 2020, SFENTA also announced the establishment of Elevate ENT Partners, a new management service organization (MSO) supported by Audax that aims to offer independent physicians a platform alternative to that provided by hospital networks and insurance providers with the goal of using this network to acquire additional practice groups across the US. There is certainly no shortage of dealmaking potential in ENT/allergy for PE firms like Audax, Shore Capital Partners, and others to investigate, with less than 1% consolidated to date, according to a recent estimate. Additionally, the market is still undercapitalized, as few targets in the sector had any institutional backing at the time of purchase.

The emergence of top MSOs that support independent partner groups—of which Minnesota-based ENT Partners is a notable example—is demonstrated by the development of Elevate ENT Partners shortly after SFENTA's agreement with TENTS. Since its founding in 1977, the organisation has only publicly acknowledged receiving growth money from Candescent Partners in 2018. Arlington ENT and Specialty Care Institute, both located in Illinois, have previously been acquired by ENT Partners by the end of 2020. In recent years, add-on activity like this has propelled PE dealmaking.

Financial sponsors can provide a special value proposition by making up for these drawbacks of independence while letting seller physicians keep many of the benefits of independent practise. Financial sponsors can also help rural areas. The introduction of the COVID-19 vaccination has demonstrated how concentrated treatment is in metropolitan areas. PE has a benefit in this situation since it can reach remote areas via buy-and-build tactics that incorporate supplemental care options with back-office assistance. In addition to lessening the burdensome responsibilities for doctors, the knock-on consequences include savings for patients on routine operations. In fact, the typical cost of more frequent ENT treatments, including tonsil ectomy in an outpatient clinic, is frequently half that of the procedure's cost in a traditional hospital setting.

A key point to note here is that the estimated number of people with asthma in the US is 24 million, including more than 6 million children, and the occurrence of seasonal allergic rhinitis (i.e., hay fever) in children, historically in the South and Southeast of the US, according to the Asthma and Allergy Foundation of America is 15%.

Top Investors in US ENT/allergy deals, 2010-2020:

Investor Name | Investment Count |

Shore Capital Partners | 31 |

Welsh, Carson, Anderson & Stowe | 28 |

Audax Group | 26 |

Webster Equity Partners | 18 |

Enhanced Healthcare Partners | 16 |

PE firms are eager to invest their resources, but they are selective in the businesses they choose to buy. There is less room for error due to rising interest rates, the potential for a recession, and stricter reimbursement and regulatory procedures. Large, best-in-class practices with strong brand equity and reputations are primarily the target of PE investors, along with smaller add-ons.

Likewise, business owners don't accept the first offer made to them. A strong cultural fit is essential since they want a PE partner who will prioritise their patients and practice. Owners can locate the ideal partners and increase transaction value with the aid of an expert investment banker who specializes in physician practice management (PPM) transactions supported by private equity.

Comments