LMM Buyout: HVAC Industry Overview

- nipunkapur5678

- Sep 18, 2023

- 2 min read

Updated: Oct 26, 2024

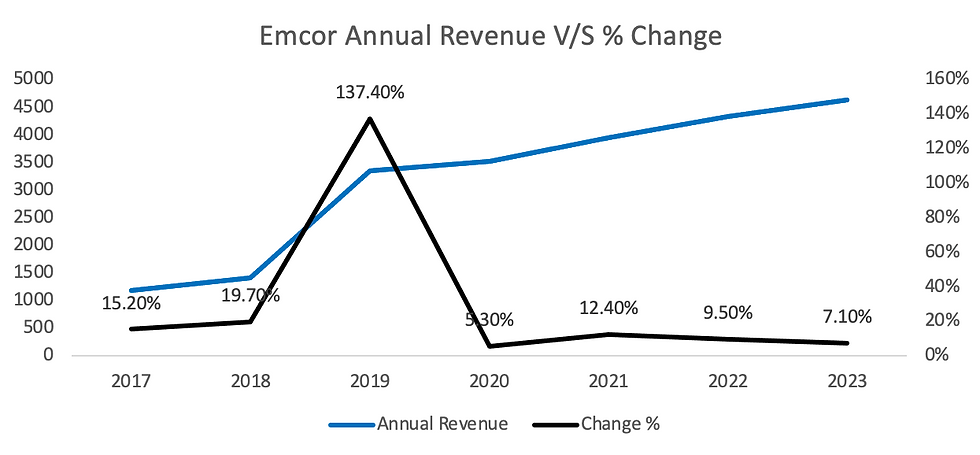

1) Emcor Group Inc. (public)

Quick Facts:

Industry Market Share | 3.80% |

HQ | Conneticut, USA |

Employee Count | 35,500 |

Performance secret sauce?

· The company’s own subsidiary- Shambhaugh & Son LP built a new whey drying plant for MWC LLC resulting in increased operating efficiency, sustainability and employee safety. Despite COVID-19 restrictions, the company was able to oversee all disruptions because EMCOR’s US Industrial building services grew by ~73% in 2021.

· The company also acquired Quebe in 2020. Hence has been able to tap on inorganic growth.

· The company invests heavily in fire protection. Taking a hint from the market trends, the company began focusing on non-residential construction markets. The demand for the fire protection lead the company to adapt and as a result, increase its profits.

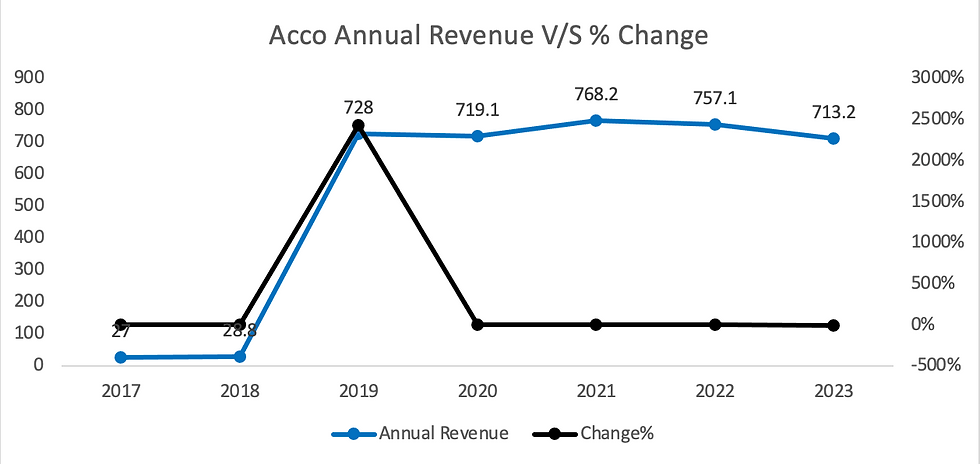

2) Acco Engineered Systems:

Quick Facts:

Industry Market Share | 0.6% |

HQ | California, USA |

Employee Count | 3,000 |

Performance Secret Sauce?

· In a June 2019 announcement, ACCO Engineered Systems (ACCO) said that it has acquired Smith Electric Service as a subsidiary in the Central Coast of California's construction and facility service markets.

· Multiple acquisitions- Applied Mechanical and Pyramid Mechanical Services located in Northern Nevada.

· Made changes to its board of directors and assumes that external perspective will provide the company with better perspectives.

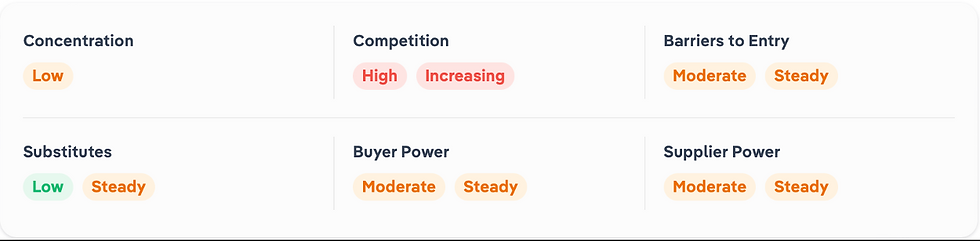

Impacts to the industry’s market share:

· Easy Entry leads to high number of new entrants and owner operators

· Requires high upfront investments in large non-residential market due to increased complexities. This makes it easier for big players to have an influence in this market.

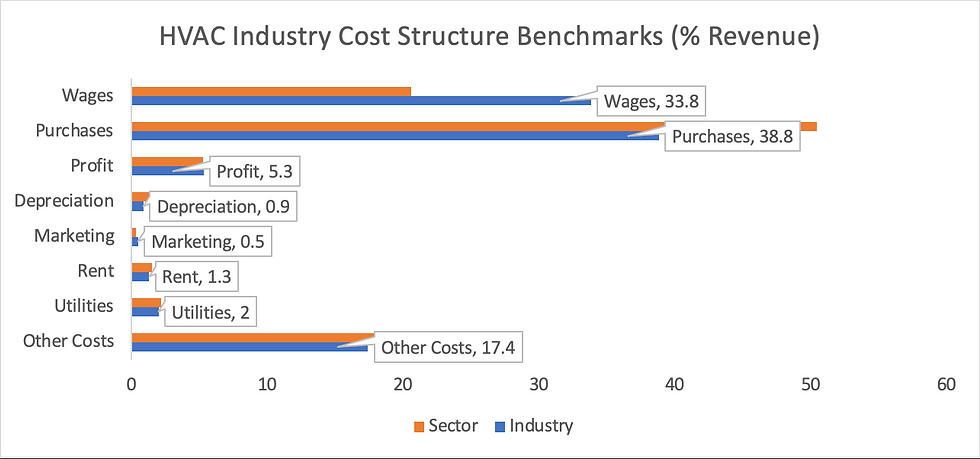

Trends Impacting Industry Costs:

1) Limited use of equipment means low depreciation:

· Depreciation is anticipated to comprise 0.9% of revenue in 2023.

2) Higher input prices cause purchase costs to rise modestly

· In 2023, purchases are expected to comprise 38.8% of revenue.

· Gasoline is also necessary for the transportation of materials and contractors.

· Supply chain issues in the wake of the recovery from the pandemic have caused the prices of key inputs to increase, leading to a modest rise in purchase costs.

3) Diverse Miscellaneous costs

· Comprising 17.4%, miscellaneous costs include legal fees, licensing expenses, consulting services, insurance payments.

· Consulting services are sought after when HVAC contractors need more information about a structure they're working on.

4) Rise in wages:

· Covering roughly 33%, introduction of new technology like IoT systems and touch-control thermostats have made the wages go up.

· Demand in educated workforce has increased, increasing the wages of this ‘new’ workforce.

Comments